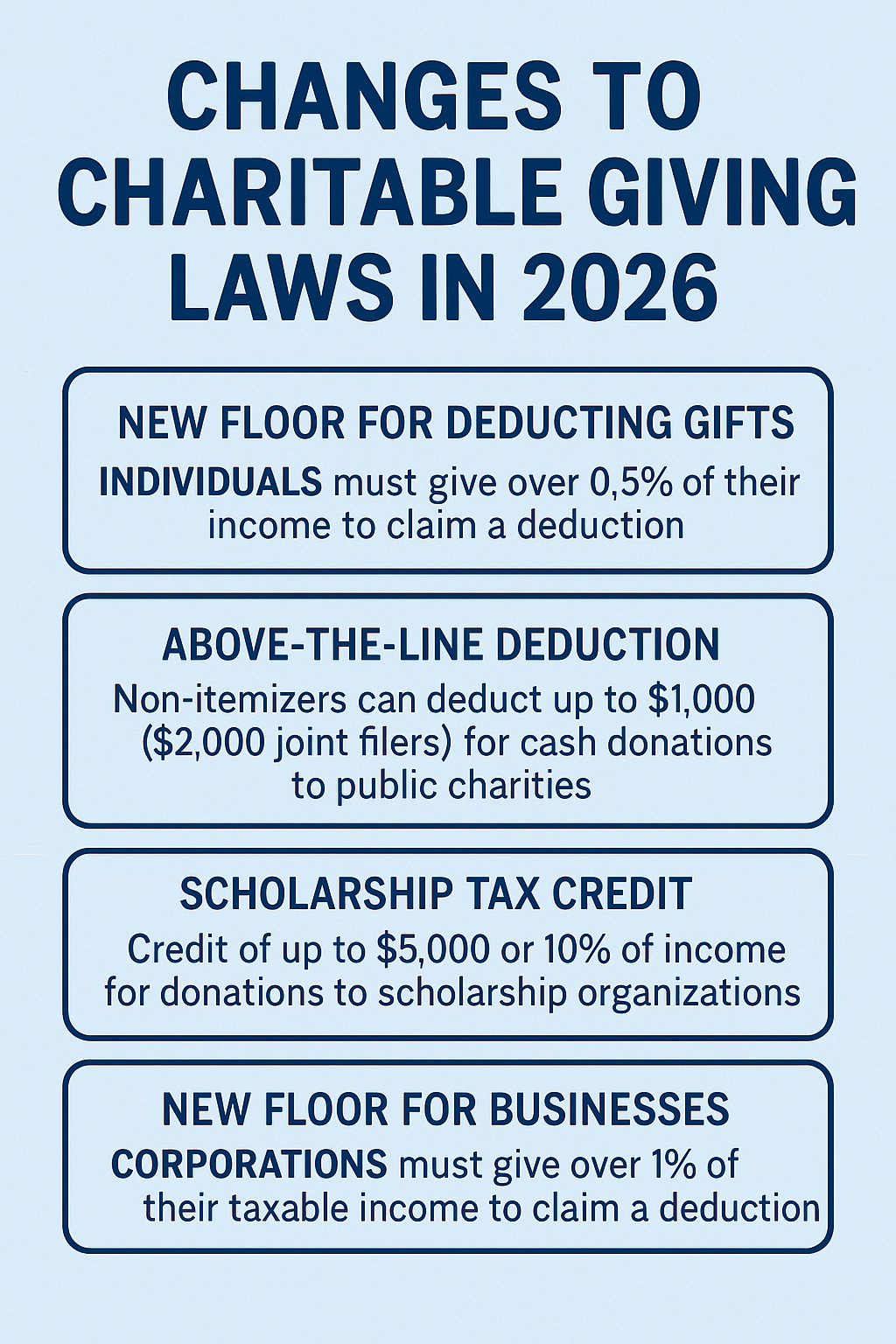

Starting in 2026, new federal tax laws will take effect that could impact how individuals and businesses give to nonprofits like Operation Freedom Paws. These changes were signed into law on July 4, 2025, as part of the One Big Beautiful Bill Act (OBBBA) and are designed to adjust tax benefits tied to charitable donations.

We want to help you understand what’s changing, what’s staying the same, and how you can continue making the most of your generosity.

What’s Changing for Individual Donors

If you itemize deductions:

-

You’ll only be able to deduct charitable contributions above 0.5% of your income.

(Example: If your adjusted gross income is $100,000, only contributions above $500 will be deductible.)

If you do not itemize:

-

There’s good news. You’ll now be able to deduct up to $1,000 (or $2,000 for joint filers) for cash gifts to public charities like OFP — even if you take the standard deduction.

-

This above-the-line deduction does not apply to gifts made to donor-advised funds or private foundations.

For scholarship donations:

-

A new tax credit is available for contributions to eligible scholarship organizations.

-

This nonrefundable credit is worth up to $5,000 or 10% of your income, whichever is less.

What’s Changing for Businesses

If you represent a corporate partner or business donor:

-

Starting in 2026, businesses can only deduct charitable contributions that exceed 1% of their taxable income.

-

The total deduction remains capped at 10% of taxable income.

-

Donations that fall below 1% won’t be deductible right away, but in some cases may be carried forward to future tax years.

How These Changes Might Affect Giving

These new rules may reduce tax benefits for smaller one-time gifts, especially for those who itemize. However, there are still many ways to make your giving work harder for both you and the causes you care about:

-

Bigger Impact, Bigger Benefit: Consider consolidating gifts into larger amounts once or twice a year.

-

Monthly Giving: Regular giving may help you meet the new deduction thresholds while providing consistent support to nonprofits. Join our monthly giving program and become a sustaining supporter of OFP’s life-saving mission.

-

Pledge Now, Plan Ahead: Multi-year pledges or planned gifts can offer future impact and current tax planning benefits.

-

Talk to a Tax Professional: Everyone’s financial situation is different, and a tax advisor can help you decide how best to give under the new rules.

Let’s Keep Saving Lives Together

Operation Freedom Paws relies on the generosity of donors like you to match service dogs with veterans, first responders, children, and others living with disabilities. These new laws might change how giving looks on paper, but your support will always make a real impact in our clients’ lives.

If you have questions about how these changes may affect your giving strategy, we’re happy to talk with you and share ideas.

Thank you for being part of our mission.

Jilliann Matteucci

Director of Development

Contact Me | (408) 389-1221